The Definitive Guide to Which Type Of Bankruptcy Should You File

Fascination About Chapter 7 Vs Chapter 13 Bankruptcy

Table of ContentsAll about Best Bankruptcy Attorney TulsaNot known Details About Chapter 7 - Bankruptcy Basics What Does Chapter 7 - Bankruptcy Basics Mean?The Basic Principles Of Chapter 13 Bankruptcy Lawyer Tulsa The Tulsa Bankruptcy Legal Services Diaries

The statistics for the various other primary type, Chapter 13, are even worse for pro se filers. Suffice it to claim, speak with a legal representative or two near you who's experienced with personal bankruptcy legislation.Several attorneys additionally offer cost-free examinations or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is certainly the best selection for your circumstance and whether they assume you'll qualify.

Ad Currently that you've determined personal bankruptcy is undoubtedly the best program of activity and you hopefully removed it with an attorney you'll need to get started on the documentation. Before you dive right into all the official bankruptcy types, you should get your very own records in order.

The smart Trick of Tulsa Ok Bankruptcy Attorney That Nobody is Talking About

Later on down the line, you'll actually need to confirm that by revealing all kinds of details about your economic affairs. Here's a basic checklist of what you'll require when traveling ahead: Identifying documents like your driver's permit and Social Safety and security card Tax returns (approximately the previous 4 years) Proof of earnings (pay stubs, W-2s, freelance earnings, income from assets along with any type of earnings from government advantages) Financial institution statements and/or pension statements Evidence of value of your assets, such as automobile and realty assessment.

You'll want to understand what kind of financial debt you're attempting to deal with.

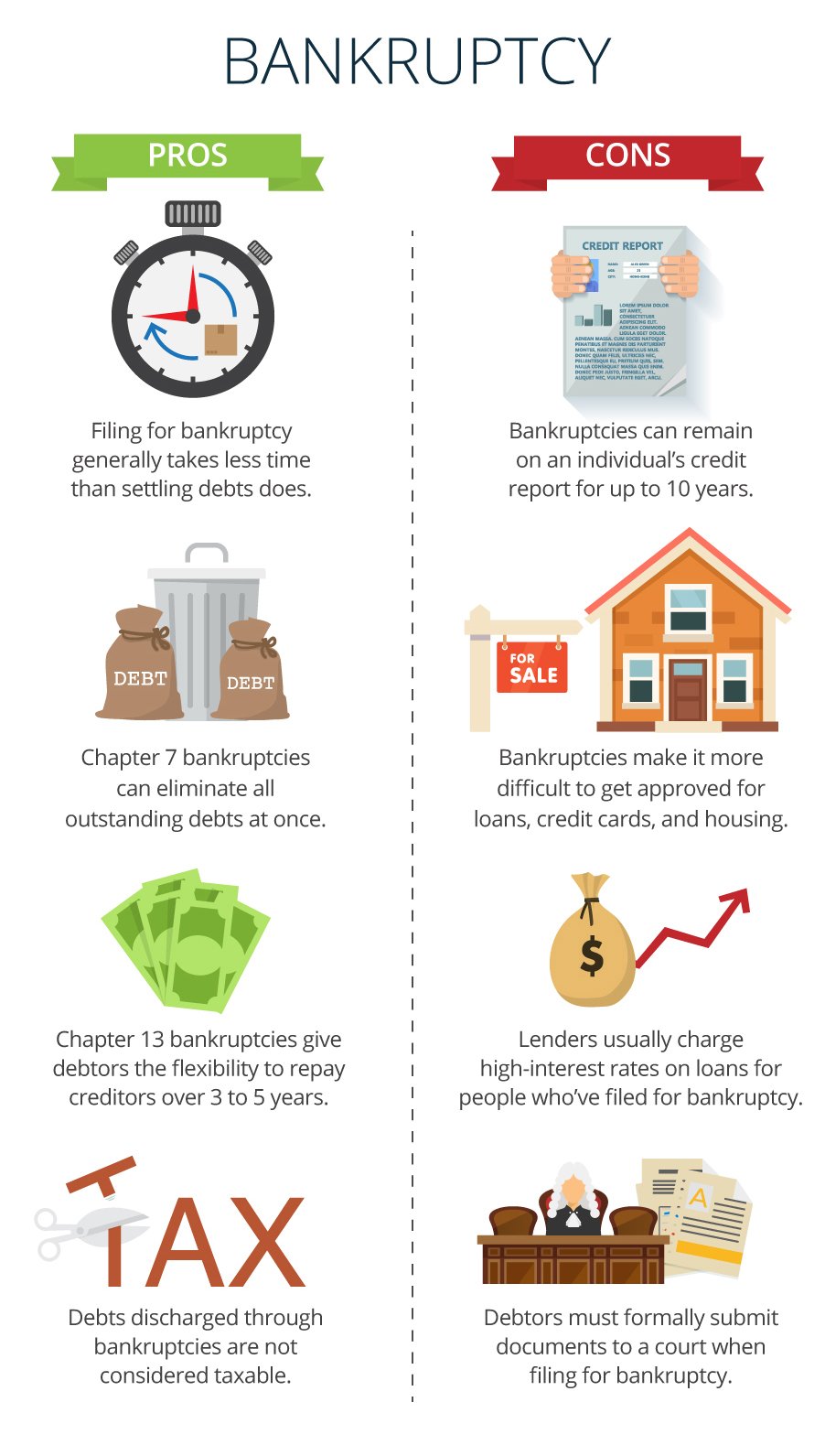

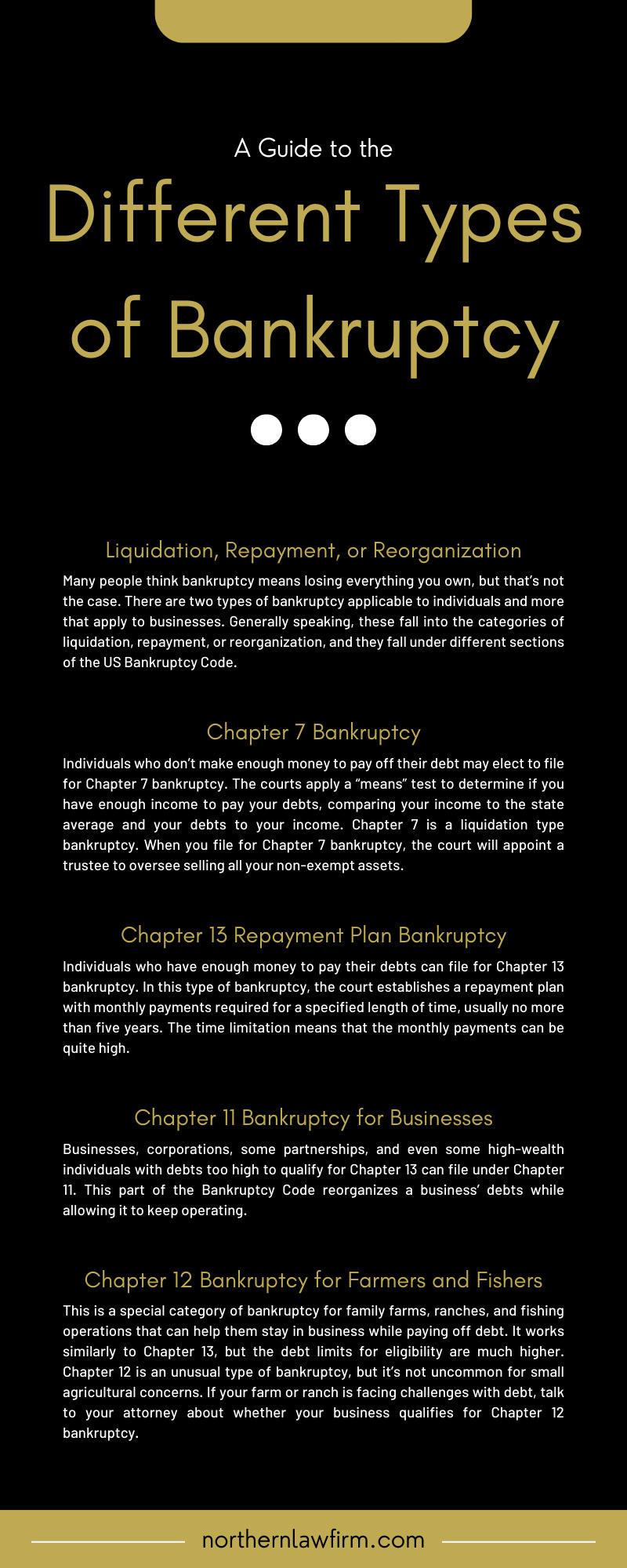

You'll want to understand what kind of financial debt you're attempting to deal with.If your earnings is too expensive, you have another choice: Phase 13. This choice takes longer to fix your debts since it needs a long-lasting settlement plan generally three to five years before some of your remaining financial obligations are cleaned away. The declaring procedure is also a great deal extra complex than Phase 7.

The 6-Minute Rule for Chapter 7 Vs Chapter 13 Bankruptcy

A Phase 7 insolvency stays on your credit rating record for 10 years, whereas a Phase 13 bankruptcy falls off after 7. Before you submit your personal bankruptcy forms, you have to first finish a compulsory course from a credit scores counseling agency that has been authorized by the Division of Justice (with the significant exemption of filers in Alabama or North Carolina).

The training course can be finished online, personally or over the phone. Programs usually cost between $15 and $50. You need to complete the course within 180 days of declare personal bankruptcy (bankruptcy lawyer Tulsa). Make use of the Department of Justice's internet site to locate a program. If you reside in Alabama or North Carolina, you have to select and complete a course from a listing of separately authorized providers in your state.

The Best Strategy To Use For Tulsa Debt Relief Attorney

A lawyer will usually manage this for you. If you're filing by yourself, understand that there are regarding 90 various insolvency districts. Check that you're filing with the proper one based upon where you live. If your long-term residence has relocated within 180 days of filling, you must file in the district where you lived the greater part of that 180-day period.

Usually, your personal bankruptcy attorney will collaborate with the trustee, yet you might require to send out the person records such as pay stubs, tax obligation returns, and savings account and credit score card declarations directly. The trustee who was just designated to your case will certainly quickly set up a mandatory conference with read this you, called the "341 conference" because it's a need of Section 341 of the united state

You will need to give a timely checklist of what qualifies as an exception. Exemptions might relate to non-luxury, primary lorries; essential home products; and home equity (though these exemptions policies can differ widely by state). Any building outside the list of exceptions is thought about nonexempt, and if you don't offer any type of checklist, after that all your home is thought about nonexempt, i.e.

You will need to give a timely checklist of what qualifies as an exception. Exemptions might relate to non-luxury, primary lorries; essential home products; and home equity (though these exemptions policies can differ widely by state). Any building outside the list of exceptions is thought about nonexempt, and if you don't offer any type of checklist, after that all your home is thought about nonexempt, i.e.The trustee wouldn't offer your sports car to quickly repay the lender. Rather, you would pay your creditors that quantity throughout your repayment strategy. An usual false impression with personal bankruptcy is that once you file, you can stop paying your debts. While personal bankruptcy can assist you erase much of your unprotected debts, such as overdue medical costs or personal finances, you'll intend to keep paying your regular monthly repayments for guaranteed financial obligations if you wish to keep the building.

Getting My Tulsa Bankruptcy Filing Assistance To Work

If you're at risk of foreclosure and have actually worn down all other financial-relief choices, after that filing for Chapter 13 may delay the repossession and assistance conserve your home. Inevitably, you will certainly still require the earnings to continue making future home mortgage settlements, as well as settling any type of late settlements over the program of your payment strategy.

The audit can postpone any type of financial debt alleviation by a number of weeks. That you made it this far in the process is a good sign at the very least some of your financial obligations are eligible for navigate to this web-site discharge.